crossposted from my blog

There are two ways we miscalibrate risk.

- We risk too much on things that are low conviction

- We risk too little on things that are high conviction

I learned these lessons in poker and in trading and they have helped me reason about broader life. I call them the fold pre principle and the pocket ace principle.

the fold pre principle

On poker forums there’s a running gag. Whenever someone posts a complicated hand history and asks, “What should I have done here?” the top reply is “fold pre.”

Translation: You never should have played that hand in the first place.

It’s a snarky answer that skips all of the nuance but that’s exactly the point. The simplest fix was to never enter that low conviction spot at all. Everyone knows that they should cut their losers early but the fold pre principle is to avoid low conviction bets entirely.

In trading you see this manifest as someone who takes a low conviction trade and then refuses to stop out of it, doubling and tripling down until either they are back at breakeven or they have blown up their account. Traders underestimate how much losing money distorts their judgment, creating a left tail doom spiral.

You see these martingales in real life as well.

- An unhappy couple clings to the relationship because “we have so much history.”

- A friend stays at a dead end job promising to quit “after one more year.”

A common litmus test to tell if you are in one of these situations is to ask yourself if you were free of these commitments at no cost, would you still choose it today?

- Would you re-enter the position?

- Would you get back into the relationship?

- Would you reapply for the job?

Poker players say fold pre, traders say cut your losers early, tech founders say fail fast. They all orbit the same law. Sunk cost habits kill asymmetric bets. If you don’t learn to prune the losing bets quickly, every “small” risk you take hides a fat left tail that can siphon your time, resources, and emotions.

I think it’s important for a person to go through a prolonged negative feedback loop or two. I wasted years with an addiction to video games and weed. Spewed off multiple poker bankrolls in fits of rage. Stayed in a relationship for too long out of nostalgia. Pushed through a startup idea I never truly believed in because quitting felt like failure.

Each scar has taught me to distrust certain impulsive tendencies that have led me off of cliffs. As I age and understand myself better, I am improving at folding earlier, and avoiding certain hands altogether.

the pocket ace principle

The pocket ace principle is:

- When you’re dealt pocket aces, bet the house.

- Recognizing pocket aces becomes second nature with experience

The world is winner-takes-most and outcomes are distributed along power laws. Poker is no different. In a live sample of 1 million hands1, the top 20 starting hands (88+, AJo+) capture almost all of the profit in the game and the other hands bleed it all back. If you can play only premium hands without others noticing, you absolutely should.

In poker that hand strength is trivial to simulate, allowing you to confidently identify which hands your strategy should revolve around. This makes poker a useful baseline, as recognizing pocket aces becomes significantly harder as you move into more complex systems.

In trading things get messier. Every situation is slightly different and the threat of adverse selection from latent risks are always lurking out of sight. You can never be absolutely certain you’re holding a winner. However even if you miss the chance to play aces, the system always marks to market, letting you measure counterfactuals and recalibrate your strategy for the next trade. Trade for long enough and you will eventually encounter a rare opportunity where fundamentals, positioning, and catalysts align cleanly for a career defining trade that must be sized.

Legendary hedge-fund manager Stan Druckenmiller famously said:

The greatest trades look blindingly obvious after the fact.

Most traders eventually arrive at the conclusion that the most effective way to trade is prepare for the few times a year there is money literally sitting on the floor. For example the memecoin frenzy in crypto after the election created a wave of deca-millionaires who were just at the right place at the right time. If you’re patient enough to wait for these rare bursts of opportunity, one good trade can fund a lifetime.

Life, however, is the most nebulous game of all. You glimpse only a blurred corner of your hand, the deck is infinite, and the counterfactuals arrive years and decades later dressed as regret. Life’s biggest pots in lasting friendships, great mentors, purpose, and love, start with a few lucky draws but only pay off when you bet aggressively with conviction.

I’ve only sized a few pocket aces in my life so far. Meeting my best friend, building a trading firm, and connecting with great mentors each felt obvious and effortless in the moment. They all began by exploring the intersection of what I genuinely enjoyed and what reliably made money so that when the right person or opportunity appeared I could drop everything and fully commit. I acted decisively not just because it felt enjoyable and it felt intuitively right, but because financial incentives clearly aligned much like the conditions that define a great trade.

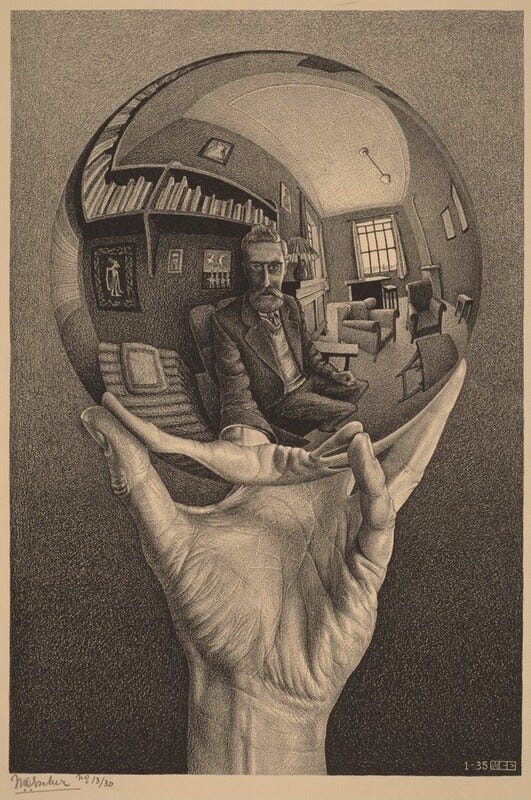

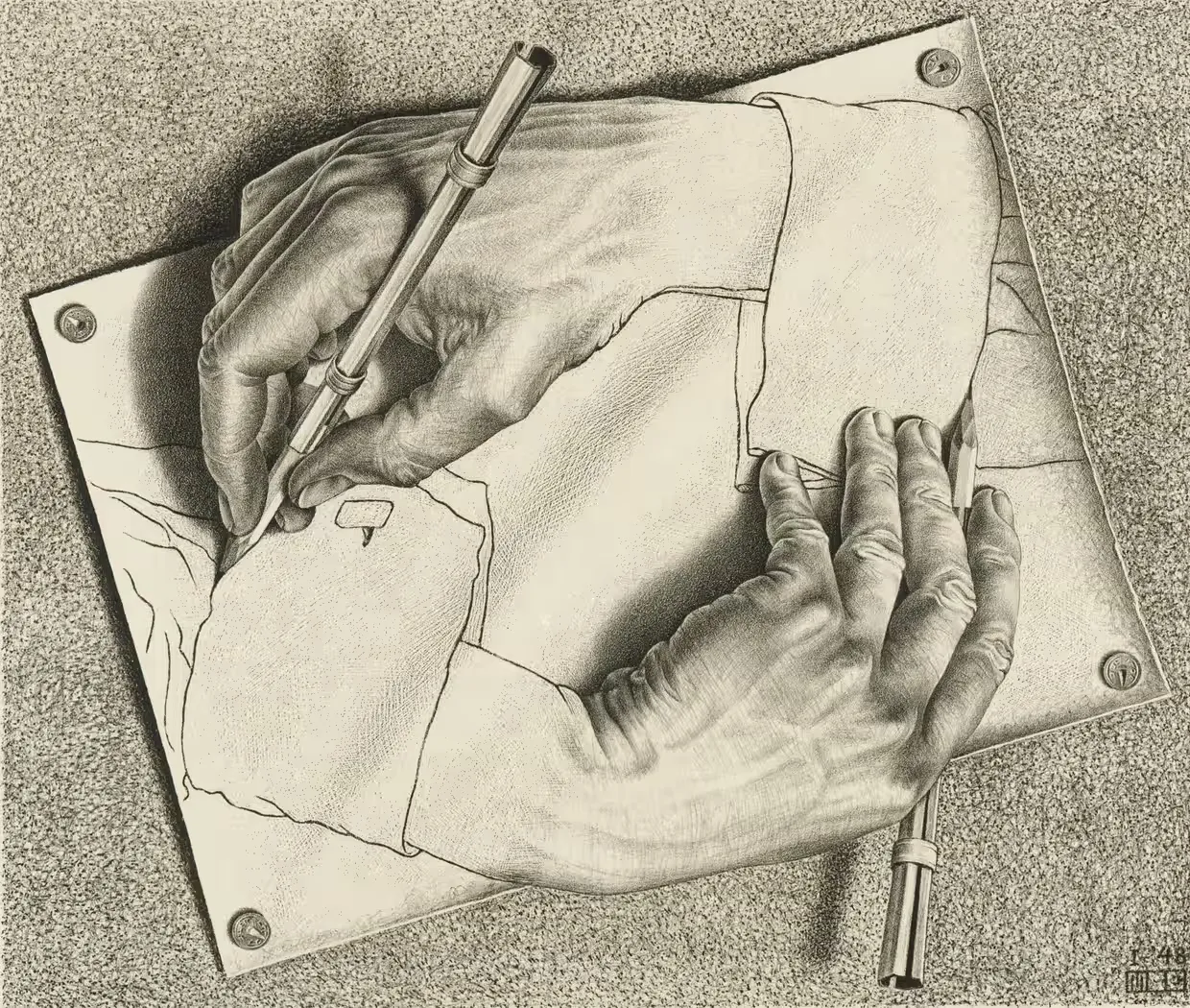

Reflecting on this, I’ve realized how money simplifies complexity. It’s a clean signal that you’re doing something right, a clarity other areas in life often don’t provide. Maybe I have always been drawn to video games, board games, and sports and competition because the outcomes are directly measurable and stimulate clean positive feedback loops in my dopamine system. It’s obvious when I have pocket aces, and it’s obvious when I’m winning. These toy examples have simplified complex systems that have helped me reveal truths about myself and the world around me. My path from video games to poker to trading was a progression of playing games with increasing complexity that has developed my taste in the the types of risk I aggressively bet on and the ones I decide to fold preflop.

I find that people often overplay their marginal hands. Old people wistfully saying they wished they had taken more risk shows that there’s a cultural counterfactual. It’s hard to fold the best hand you’ve ever seen. A power law world means pocket aces are rare. And unimaginably good. And if you’re young it’s possible you haven’t even ever seen them before. If you’re busy playing an okay hand when aces finally arrive you might miss them. So stretch your imagination with how good life can get. Cultivate patience. Be comfortable with waiting with apparent idleness, with refusing to trade “great” for merely “good.” And trust that the nonlinear payoff will come.